Page 20 - Annual Review 2021 full

P. 20

Indian National Shipowners’ Association

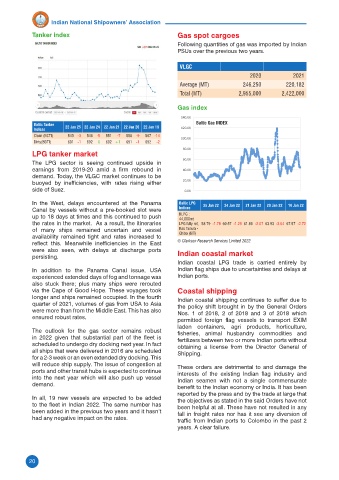

Tanker index Gas spot cargoes

Following quantities of gas was imported by Indian

PSUs over the previous two years.

VLGC

2020 2021

Average (MT) 246,250 220,182

Total (MT) 2,955,000 2,422,000

Gas index

140.00

Baltic Tanker 22 Jan 25 22 Jan 24 22 Jan 21 22 Jan 20 22 Jan 19 Baltic Gas INDEX

Indices 120.00

Clean (BCTI) 543 -3 546 -5 551 -7 558 -9 567 -14

100.00

Dirty(BDTI) 691 -1 692 0 692 +1 691 -1 692 -2

80.00

LPG tanker market

60.00

The LPG sector is seeing continued upside in

earnings from 2019-20 amid a firm rebound in 40.00

demand. Today, the VLGC market continues to be

buoyed by inefficiencies, with rates rising either 20.00

side of Suez. 0.00

In the West, delays encountered at the Panama Baltic LPG 25 Jan 22 24 Jan 22 21 Jan 22 20 Jan 22 19 Jan 22

Canal by vessels without a pre-booked slot were Indices

up to 18 days at times and this continued to push BLPG :

44,000mt

the rates in the market. As a result, the itineraries LPG fully ref, 58.79 -1.78 60.57 -1.29 61.86 -2.07 63.93 -3.64 67.57 -2.72

of many ships remained uncertain and vessel Ras Tanura -

availability remained tight and rates increased to Chiba ($/T)

reflect this. Meanwhile inefficiencies in the East © Clarkson Research Services Limited 2022

were also seen, with delays at discharge ports Indian coastal market

persisting.

Indian coastal LPG trade is carried entirely by

In addition to the Panama Canal issue, USA Indian flag ships due to uncertainties and delays at

experienced extended days of fog and tonnage was Indian ports.

also stuck there; plus many ships were rerouted

via the Cape of Good Hope. These voyages took Coastal shipping

longer and ships remained occupied. In the fourth Indian coastal shipping continues to suffer due to

quarter of 2021, volumes of gas from USA to Asia the policy shift brought in by the General Orders

were more than from the Middle East. This has also Nos. 1 of 2018, 2 of 2018 and 3 of 2018 which

ensured robust rates. permitted foreign flag vessels to transport EXIM

laden containers, agri products, horticulture,

The outlook for the gas sector remains robust fisheries, animal husbandry commodities and

in 2022 given that substantial part of the fleet is fertilizers between two or more Indian ports without

scheduled to undergo dry docking next year. In fact obtaining a license from the Director General of

all ships that were delivered in 2016 are scheduled Shipping.

for a 2-3 week or an even extended dry docking. This

will reduce ship supply. The issue of congestion at These orders are detrimental to and damage the

ports and other transit hubs is expected to continue interests of the existing Indian flag industry and

into the next year which will also push up vessel Indian seamen with not a single commensurate

demand.

benefit to the Indian economy or India. It has been

reported by the press and by the trade at large that

In all, 19 new vessels are expected to be added the objectives as stated in the said Orders have not

to the fleet in Indian 2022. The same number has been helpful at all. These have not resulted in any

been added in the previous two years and it hasn’t fall in freight rates nor has it see any diversion of

had any negative impact on the rates. traffic from Indian ports to Colombo in the past 2

years. A clear failure.

20